service tax new mexico

This tax is imposed on persons engaged in business in New Mexico. Businesses that sell services across.

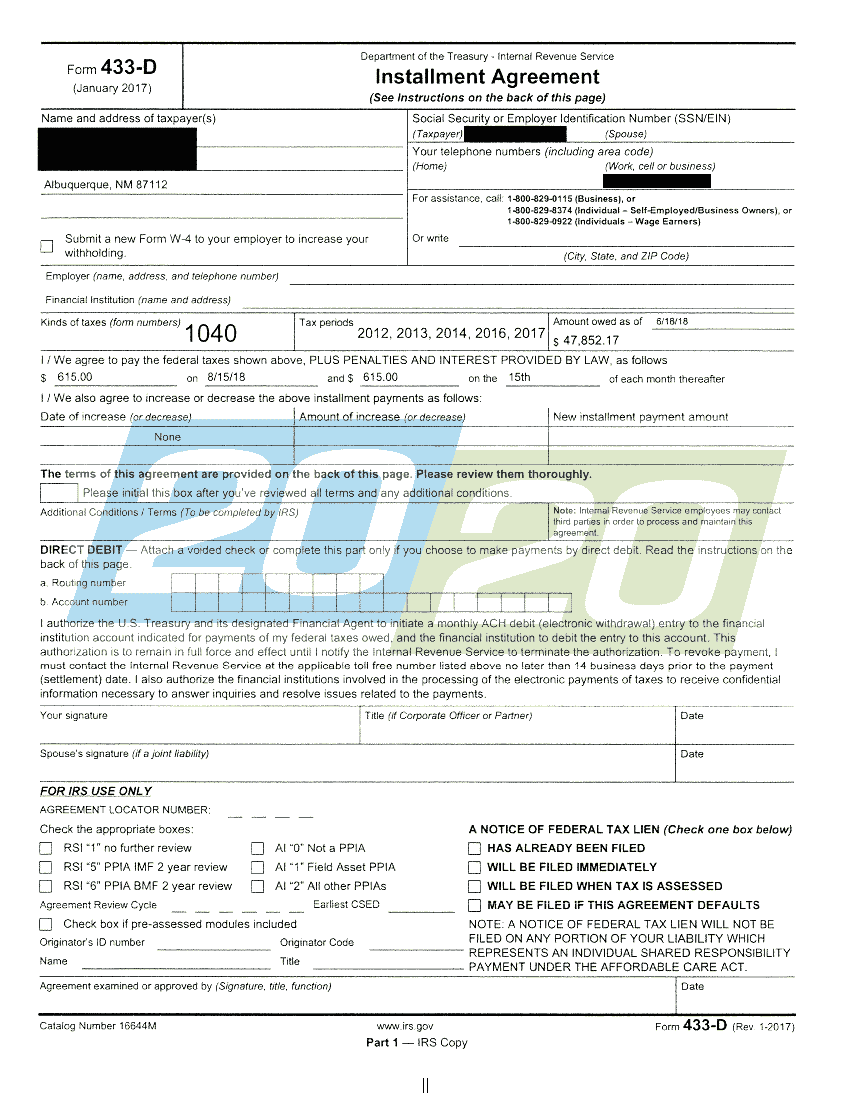

Irs Accepts Installment Agreement In Albuquerque Nm 20 20 Tax Resolution

Personal income tax rates for New Mexico range from 17 to 49 within four income brackets.

. Departments and Agencies. The taxable wage base for wages paid during calendar year 2019 was 2480000. New Mexico Judiciary Branch.

The taxable wage base. New Mexico Capitol Annex North 325 Don Gaspar Suite 300 Santa Fe NM 87501. This page describes the taxability of.

The change in sourcing rules will put New Mexico more in line with other states that require remote sellers and marketplace facilitators to collect and remit tax. The taxable wage base for wages paid during calendar year 2020 was 2580000. Delaware Hawaii New Mexico and South Dakota tax most services.

New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. Hours of Operation 800 AM - 500 PM Monday through Friday. As of 7121 New Mexico is considered a destination-based sales tax state.

The Gross Receipts tax rate now is calculated based on where the goods or products of services are delivered. While New Mexicos sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. New Mexico Administrative Code.

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of. NE Albuquerque New Mexico 87123. Jackson Hewitt Tax Service Tax Preparation Service 400 Eubank Blvd.

This tax is sometimes called. 9 The individual income tax rates are listed in the table below. The Mission of the New Mexico Judiciary is to protect the rights and liberties of the people of New Mexico guaranteed by the Constitution and laws of the State.

Job in Las Cruces - Dona Ana County - NM New Mexico - USA 88005. In almost every case the person engaged in business passes the tax to the consumer either separately. Instead of collecting a sales tax New Mexico collects a gross receipts tax.

The business almost always passes the tax onto the consumer either as a separate line item or as part of the retail. Compensating tax Section 7-9-7 NMSA 1978 is an excise tax imposed on persons using tangible property services licenses or franchises in New Mexico. The former presidents lawsuit against James comes the same week that his company the Trump Organization is on trial for criminal tax fraud - on the hook for what.

Still others like Texas and Minnesota are actively expanding service taxability. The Taxation and Revenue Department serves the State of New Mexico by providing fair and efficient tax and motor vehicle services. Credentialed Tax Professional.

It administers more than 35 tax.

New Mexico Form 2290 Heavy Highway Vehicle Use Tax Return

New Mexico State Tax Information Support

New Mexico Taxpayers Encouraged To File Personal Income Tax Forms Electronically Krqe News 13

A Guide To New Mexico S Tax System New Mexico Voices For Children

Aarp Foundation Free Tax Aide Alamogordo Nm

2021 Session Wrap Up Of The New Mexico State Legislature Nfib

New Mexico Among States Cutting Corporate Income Tax Rates In 2017 Albuquerque Business First

A Guide To New Mexico S Tax System New Mexico Voices For Children

Santa Fe Public Library Tax Help Nm

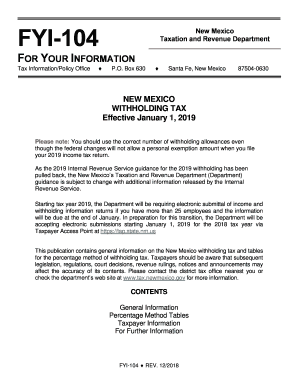

New Mexico Fyi 104 Fill Out And Sign Printable Pdf Template Signnow

New Mexico Sales Tax Guide Lovat Compliance

Tax Help New Mexico At Your Service Cnm

Home Taxation And Revenue New Mexico

Get To Know Tax Help New Mexico An Interview With Jeffrey Ledbetter Director Of Tax Help New Mexico Prosperity Now

Tax Problems Settled New Mexico 20 20 Tax Resolution

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

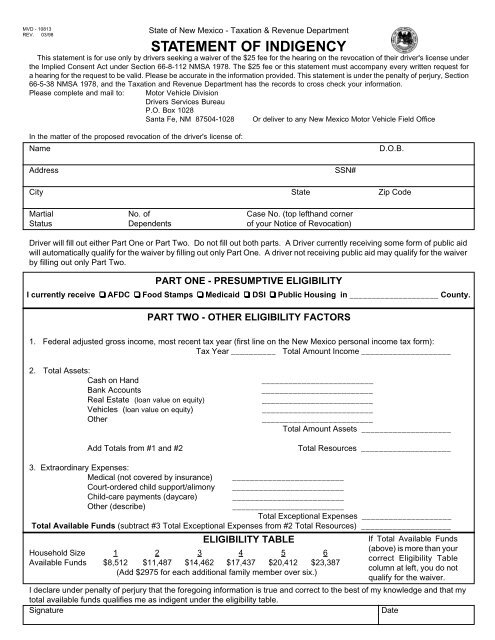

Statement Of Indigency Mvd10813 A One Title Service

Important Tax Filing Changes To Benefit New Mexico Families Krqe News 13